未分類

To purchase good Fixer-Top Family: What you should See

According to everything you get a hold of on television suggests, to invest in a beneficial fixer-top appears like a means to make lots of cash with some earliest Do-it-yourself. But unfortunately, the truth is a small other. Toward one-hand, fixer-top households can be very reasonable and you will a solid investment. On the other side, they’re able to and additionally ver quickly become money pits.

Need a very good Finances

Like any a property transaction, buying an effective fixer-higher needs undertaking an air-limited income. Before you even start appearing, you need to know what you are able afford. In the place of a normal a house transaction, although not, your allowance needs to reason for the price of fixes, additionally the home’s price, closing costs and all the individuals almost every other hidden charge.

After you would a budget getting a good fixer-top, you prefer a firm profile planned your happy to invest in your panels. Make sure you incorporate a supplementary fifteen% due to the fact probably the most useful-placed preparations never usually bowl away. With this particular shape planned, you’ll end up top placed to determine exactly what level of renovations you can afford, which can determine the most suitable homes for you.

You have got Various Money Alternatives

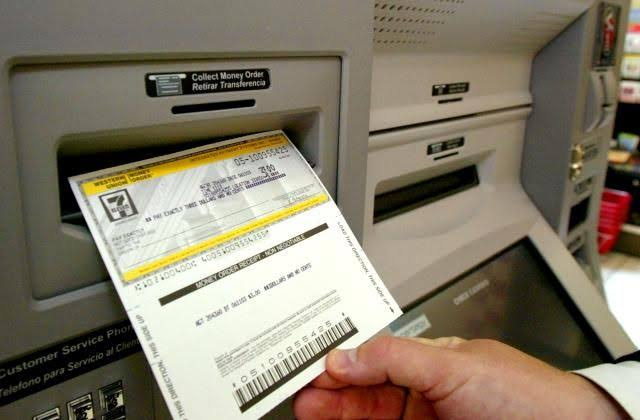

When you are we’re talking about spending plans, it is worthy of knowing that in both Canada plus the You.S., you can take out a different home loan geared towards fixer-uppers. Regarding U.S., you have the adopting the choice:

- Federal national mortgage association HomeStyle Loan: Fund to possess home improvements go into a keen escrow membership to pay builders; an effective 5% deposit becomes necessary; all the way down interest rates than HELOC; can be used for no. 1 and you can travel home, together with financial support features.

- Freddie Mac’s CHOICERenovation Financial: A great 5% downpayment is needed; down interest rates than just HELOC; are used for number 1 and you may vacation land, as well as financial support characteristics.

- FHA 203(k) loan: The price of renovating and purchasing your house is folded for the one to loan; straight down credit rating requirement than the a normal financing.

- Virtual assistant repair loan: The cost of renovating and buying the house is rolled to your that loan; need use an excellent Virtual assistant-approved company.

Meanwhile, in Canada, you’re qualified to receive a repair financial, which includes straight down rates of interest and you will a lengthier amortization months that have straight down repayments.

You have the property Thoroughly Inspected

It’s always good to have your prospective new home examined because of the a house inspector, but with good fixer-higher, its important. Actually, you will find several authoritative inspections which can be well worth paying a small regarding to make certain you are not to acquire a property that have tall trouble.

- Pest inspections: Important in areas having termite, ant or beetle difficulties.

- Rooftop certifications: Brings evidence of this and you will status of the rooftop.

- Sewage checks: Aging septic tanks and you will sewage outlines can cost too much to replace.

- Systems statement: Reveals any current or prospective pure or geological perils.

While doing so, be sure to possess foundations, Hvac assistance and you may electricity assistance very carefully searched, because these normally very costly and you may day-consuming to repair. In the event the you will find facts, they are often maybe not worth the pricing otherwise effort to resolve, so make sure you make your promote contingent on the effect of them individuals monitors.

You prefer a strategy

You will need to thought ahead when purchasing an excellent fixer-higher, and a strong package could save plenty of worry. Such, just how much of works do you manage yourself? Might you manage to hire designers to have major jobs? Would you live on-webpages throughout renovations? Inquire these types of questions, and even if you are planning while making it your own permanently household, plan as if you’ll be promoting soon. And remember to help you arrange for delays as well, since the these Cleveland savings and installment loan include frequent in structure tactics.

Venue is key

No matter what incredible you will be making your house, you can never alter their venue. So consider, decide to offer. A great family during the a bad society, or close to loud, pungent otherwise unsightly business, will be unable to offer. Particular advice is to buy the latest worst household towards the finest path. A fixer-upper might be a great way to go into your dream people at an affordable price.