未分類

What the results are With a face-to-face Home loan Immediately after Passing?

Opposite mortgages is actually a financial product which of several property owners imagine since it ages, providing a chance to tap into their home security with out to market or move out.

If you are taking right out an opposite home loan would be good for home owners who happen to be battling financially, it can create challenge towards the homeowner’s heirs after their dying. That is because heirs exactly who inherit a home having an other mortgage do not just inherit the home. However they inherit the burden to spend right back the loan.

At the Russell Manning Attorney, I assist property owners accomplish the home considered desires if they have a contrary mortgage (or are planning on you to definitely) plus the heirs of these exactly who passed away that have an opposite home loan on their possessions. My personal lawyers is based in Corpus Christi, Colorado, however, I suffice members about Seaside Fold City and you will Southern Tx.

What exactly is an opposing Mortgage?

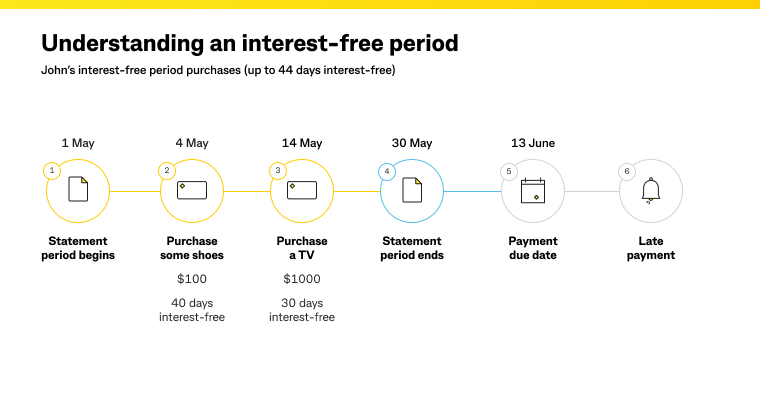

An opposing mortgage is a type of mortgage offered to homeowners that happen to be normally 62 years otherwise older, permitting them to borrow money off their domestic equity and you will convert they with the bucks. An opposite mortgage is the reverse regarding a traditional mortgage (and that title) because it is the lending company who pays the newest citizen, maybe not the other way around. Yet not, the loan need to be paid if the residence is sold otherwise the brand new debtor motions out permanently otherwise passes away.

Most opposite mortgage loans in the us try family guarantee conversion mortgages (HECMs) that exist to help you property owners through loan providers approved by the Government Property Administration (FHA).

Exactly how a reverse Mortgage Has an effect on a partner otherwise Mate if they Try good Co-Borrower

If the enduring companion or companion was a great co-borrower toward opposite home loan, the trouble adopting the borrower’s demise can be way more simple. Because a great co-debtor, the brand new thriving spouse or spouse possess equivalent legal rights and you can obligations out-of the mortgage:

Went on residence. The fresh thriving co-debtor is also keep living in the house without the need to pay back the mortgage immediately. The opposite mortgage simply become owed when the past surviving co-debtor passes away, sells the house, or motions out permanently.

Accessibility fund. The latest surviving co-debtor continues to gain access to one left funds from the opposite mortgage, depending on the modern terms and conditions.

Duty. The fresh new co-debtor need always meet with the obligations of your own mortgage, such as for instance using assets taxes, home insurance, and you may maintaining our home.

Whenever a borrower that have an opposing financial dies therefore will be the enduring co-debtor, you should notify the lending company of borrower’s death right that you could. This can begin the whole process of determining the newest loan’s status and you can 2nd steps.

Just how an opposite Home loan Influences a spouse or Partner whenever they Aren’t a good Co-Debtor

The problem gets to be more challenging if the a partner or spouse is actually not a beneficial co-debtor to your reverse financial. In this instance, brand new thriving companion or lover can get face more pressures and you may solutions.

On the latest death of the fresh new debtor, the reverse mortgage gets owed and you will payable as long as here is not any most other thriving co-debtor. This means the loan should be reduced, always in one so you’re able to half a year, even when extensions is generally you can. The brand new enduring mate otherwise mate could have a number of options to own repaying the borrowed funds:

Offer the house. In the event the selling is complete, new partner otherwise companion may use the newest proceeds to pay straight back the opposite mortgage. People remaining security shortly after installment belongs to the surviving spouse or mate.

Refinance. If eligible, the surviving companion or spouse can be re-finance the opposite home loan towards the a vintage financial otherwise a unique opposite financial in their name.

Repay the mortgage. When the readily available, the newest surviving partner otherwise companion can use almost every other assets to invest off the opposite financial balance.

Should your thriving partner or companion is not into term, heirs (such as for instance students) may also have the option to settle the loan and keep maintaining the house. Specific contrary mortgage loans become provisions to guard non-borrowing partners, allowing them to stay-in your house after the borrower’s demise. Such defenses vary of the financing kind of and financial, so if your lady otherwise companion died having an opposite financial you might has actually a lawyer comment the specific words of one’s financial.

Techniques for People which have Contrary Mortgage loans

For those who have an opposite mortgage otherwise are thinking about you to, here are some tips to assist guarantee it aligns together with your long-name requires:

Correspond with your loved ones. Of many people whom intend to take-out a contrary mortgage would perhaps not communicate with their loved ones members about it. Oftentimes, members of the family and you https://paydayloanalabama.com/auburn/ will heirs do not know anything on the a reverse financial up to pursuing the homeowner’s demise. For individuals who, just like the a homeowner, properly share your choice to acquire an other mortgage, you could potentially stop frustration and you can conflicts fundamentally.

Appoint some one you trust as executor. New conference away from a keen executor for the house is an essential action no matter whether you’ve got a contrary home loan or otherwise not. When you do, the new executor is guilty of controlling the payment process and you may emailing the financial institution.

Keep information planned. The best thing can be done are maintain structured ideas away from your contrary mortgage documents, plus statements, preparations, and make contact with recommendations for the financial. This will make it more comfortable for the heirs to know the new terms of the reverse home loan and you can do brand new fees techniques.

Talk to an attorney. Which have a reverse financial can result in specific trouble for your estate bundle. That’s why you might seek the fresh new guidance of legal counsel when you take aside an opposing mortgage or installing a home package that have an opposing financial. The lawyer will assist ensure that your reverse mortgage doesn’t pose a risk to your residence possession, nor does it carry out fears for your heirs on the sad knowledge of the death.

When you find yourself a citizen who has inquiries off an other financial concerning property think, you may want to get the assistance of legal counsel.

Explore Your situation having a lawyer

As the a home planning lawyer, I’m sure just how a contrary financial shall be incorporated a keen home package as well as how it has an effect on heirs when a homeowner entry away. If you’re a homeowner considering taking out fully a contrary mortgage in your house, I will help.

At Russell Manning Attorneys, I also assist those who inherit a property with an other home loan and want help determining what you should do during good duration of despair. Name my workplace right now to plan an instance investigations.