未分類

Virtual assistant Loan Credit Requirements Compared to Other Mortgage brokers

- Qualification Standards

- Certification from Eligibility

- Co-Signers and you may Co-Borrowers

- Credit rating Conditions

- Debt-to-Income Ratio

- Entitlement

- Occupancy Requirements

- Lowest Assets Standards

With regards to Va fund, the fresh new Service from Veterans Factors does not have any a flat lowest borrowing from the bank rating demands. However, very private Va lenders possess their unique credit history criteria, that are very different according to private lender.

Secret Concerns

- Just how can Va mortgage credit requirements compare with other types of home loans?

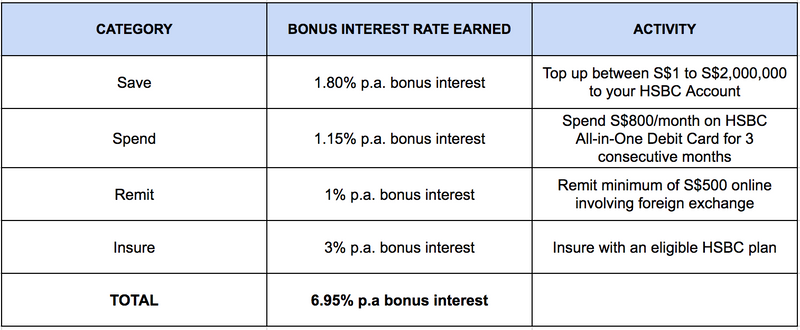

The new relaxed borrowing criteria are one of the factors that produce Virtual assistant funds favorable so you’re able to potential borrowers compared to the other kinds of home loans, for example antique, FHA and you may USDA loans. Another desk provides an introduction to the standard borrowing criteria for each and every loan kind of:

What makes credit history criteria getting Virtual assistant money less restrictive?

Since Virtual assistant fund are government-recognized, there is certainly better shelter to own personal Virtual assistant loan providers, making them a great deal more in a position and prepared to agree borrowers that have lower fico scores. The fresh new Virtual assistant doesn’t material fund truly, however, really does partially verify finance having borrowers whom meet up with the basic official certification is deemed eligible for an effective Va home loan. It verify assists mitigate the brand new lender’s chance and prompts these to give financing to prospects whom might not meet up with the strict borrowing from the bank criteria out of almost every other loan designs.

What is the minimum credit rating to own an excellent Va mortgage?

New Company out-of Experts Things (VA) does not set at least credit rating requirement so you can qualify for a Virtual assistant financing. not, really Virtual assistant lenders will need no less than good 620 FICO borrowing from the bank get to invest in the loan.

2024 Va Mortgage Credit history Criteria to find the best Lenders

As stated, minimal credit score you’ll need for an excellent Virtual assistant loan differ because of the bank. Here are a few examples of just what credit ratings a number of the best Va lenders require during the 2024:

Credit history Range to have Virtual assistant Financing

When you’re there isn’t a-flat minimum credit history importance of Virtual assistant fund, you are interested observe just how individual credit rating often hold-up in the Virtual assistant mortgage procedure. Take a look at pursuing the graph to see how many individuals such as for instance you effectively finalized to their Va funds within for each credit rating diversity a year ago:

Remember that a number of things except that their credit history will come towards enjoy whenever Va lenders is evaluating your just like the a prospective debtor, such as your financial obligation-to-money ratio or if you has a great co-signer or co-debtor. To find out more which is particular into the unique financial predicament, contact a good Va-recognized financial to ensure your qualification to have a beneficial Va mortgage. You can determine your own imagine out-of just what home price assortment would match your funds having an effective Va Mortgage Value Calculator.

How do i find out my credit score having good Virtual assistant financing?

Delivering advised concerning your own credit score is a vital initial step in this new Va mortgage procedure. If you are not yes how to start off, there are lots of with ease-accessible information to guide you for the examining your very own credit history. You can check out AnnualCreditReport more resources for credit and also demand the 100 % free credit report now!

Just remember that , the credit get you can get away from an effective credit rating site often possibly vary from the new score the home loan financial was researching. Whenever lenders pull your credit history, they generally look at FICO fico scores which can be specifically calculated getting financial credit, when you find yourself credit rating sites usually explore fico scores from simple scoring patterns. It differences may have virtually no impact on if you be eligible for an effective Virtual assistant financing, but it is nevertheless a significant factor to look at of trying in order to glance at the credit rating.

Can i score a Virtual assistant home loan with less than perfect loans Glen Allen credit?

If you have been thinking about this question, you are not by yourself! Of many possible individuals are concerned in the with less than perfect credit if any borrowing when very first going into the Virtual assistant mortgage processes. Centered on a Experian statement, the fresh new federal average FICO credit rating is 714. Experian including notes you to credit ratings below 670 fall into brand new fair or bad groups. But not, extremely Va loan providers have a tendency to generally pick the absolute minimum FICO credit rating away from 620 so you can be eligible for an excellent Virtual assistant financing.

No matter if your credit score falls less than which standard or if you don’t have a lot of to help you no credit rating, don’t give up on your goals out of homeownership. There are a variety out of activities to do to ascertain otherwise replace your borrowing and increase your chances of being qualified to have a Virtual assistant loan.

How-to Replace your Credit history to have a Va Mortgage

For those who have poor credit or the lowest credit rating, you will find actions you can follow to improve your own creditworthiness and you will enhance your probability of qualifying for a Virtual assistant loan. Listed below are some steps you can take:

Benefits of good credit to own a good Va Loan

With good credit is also somewhat effect your own Virtual assistant mortgage experience besides merely assisting you meet the requirements. Borrowers with fico scores in the 720-740 assortment can often assume best speed conditions, straight down charges and a lot more competitive rates of interest when trying to get an effective Virtual assistant mortgage.

Individuals with solid credit ratings s which have huge loan wide variety and you may a great deal more flexible payment selection. In addition, maintaining a substantial credit rating might facilitate the mortgage acceptance process, making it possible for individuals to get reduced access to finance for purchasing an excellent family or refinancing an existing mortgage. These types of advantages you certainly will translate in order to high deals along side lifetime of your loan, therefore it is useful to focus towards the enhancing your credit score in advance of moving forward with your Virtual assistant application for the loan.