未分類

Into the application for the loan processes, loads of factors might be taken into consideration, together with your credit and you may financial history

Content material

A professional financing is a type of loan which can be found having companies to cover increases, gizmos, possessions, and much more. Depending on the kind of mortgage, the amount of money need, as well as your credit score, San Antonio personal loan with no bank account brand new downpayment for industrial fund may vary.

Which may not be the solution you are looking for, but a professional financing may be the opportunity your company means. Should your downpayment is actually a major question, it could give particular morale to find out that you will find a great level of industrial financing options available so you’re able to companies during the some other degrees as well as sizes which come in range from affordability.

Regardless of if selecting the right mortgage need a good amount of research on your end, you can buy come using this type of blog post, and that information popular fund available together with off repayments that are included with them.

Certain commercial money need an appartment advance payment that’s good predetermined percentage of the quantity of the mortgage. Other business loans keeps a deposit matter one to fluctuates built on:

- The sort of financing

- Sum of money loaned

- The loan could well be made use of

- The business customer’s monetary reputation due to the fact a consumer and you will business person

Usually, which have a strong financial history, you could potentially discover a lesser interest and additionally be expected to invest a lower life expectancy down-payment.

There are numerous variety of commercial loans, and each features book criteria toward count you’ll need for a beneficial downpayment. Discover four commercial money that will be best suited for different style of organizations, and each varies regarding the quantity of advance payment necessary. Speaking of:

- SBA funds

- Commercial a residential property loans

- Providers personal lines of credit

- Term money and you will brief-title loans

SBA Money

SBA money are one of the top fund designed for companies. SBA money are supplied because of the Business Management, a company of the national. The fresh new qualifications requirements is actually strict, and some people struggle to become approved.

- SBA eight(a) finance promote small enterprises which have working-capital or as a means to fund a real estate investment.

- SBA 504 loans are used to aid in providers development by way of the purchase out-of a separate building, products, or gadgets. They are able to also be used to fund yields otherwise enhancements so you can establishment.

Even though the a few SBA fund in the above list is the several extremely popular financing, the brand new SBA provides funds which do not require a downpayment, including the SBA microloan and SBA CAPLines system. Yet not, a few of these loans is having particular types of company lenders, so make sure you investigate whether you are eligible before you apply.

Industrial A residential property Finance

One of the most preferred causes you to people seek out a beneficial loan is to buy industrial real estate. Because it is one of the main assets an excellent providers helps make, there are many commercial a property money readily available. Mindful believe and you can preserving takes some time, but it’s needed when you need to discover this type regarding mortgage.

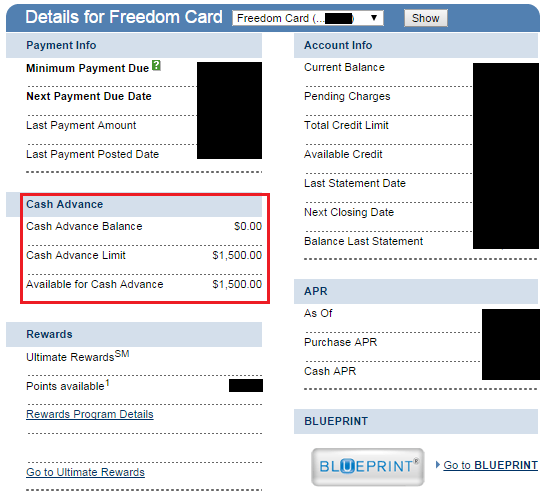

Company Personal lines of credit

Rather than the 2 alternatives i’ve already talked about, a corporate personal line of credit is not a lump sum payment off financing. Instead, a corporate line of credit ‘s the number of resource one to can be utilized in case it is called for. In other words, youre simply paying down extent you have utilized.

You would imagine away from organization lines of credit because exactly like a charge card. not, team lines of credit differ for the reason that sometimes they has actually down APRs and provide you with the means to access dollars. Youre simply necessary to pay interest on fund used.

Even though there are not any specific conditions getting being qualified to have a corporate credit line, specific need equity, along with your lender can look into your credit history to make certain your a trustworthy debtor.

Identity Loans and you may Small-Identity Loans

Short-title finance try fundamentally label loans that have a shorter repay period. An expression loan are a classic financing which is paid with attract more a duration of dependent on the lender. Label fund usually are monthly installments while small-title mortgage costs are usually each week or even everyday.

You are not certain to get the amount you may have pertain for; alternatively, a lender comes with the number he has calculated you may be capable feasibly pay, predicated on your organization’s economic profile.

You might think contributing more than the required lowest deposit if it is financially feasible. That way, you only pay less inside interest that comes with the mortgage. Significantly more advance payment, also known as guarantee injection will help bring most useful mortgage conditions and alter your month-to-month cash move.

At some point, what is important on exactly how to find the appropriate loan to have your role. Taking out fully a loan try a life threatening financial commitment. After you have completed your research, make sure you apply at a professional financial you is actually certain that the loan is the correct one for your team.

Get a hold of professional visit which have Teams.

When you’re wanting to know in regards to the advance payment getting commercial loans-otherwise any of the of a lot facts that go on the loans-spouse which have a lender at the Crews Lender & Faith.

The pros was here to simply help guide you from the loan process-out-of finding the optimum loan so you’re able to undergoing the application form processes-to make sure you’re in an educated financial position to assist your business allow it to be along with your society build.